november child tax credit schedule 2021

October 15 PAID. 15 2022 according to the District of.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The tax credit is aimed at helping parents.

. Families with a single parent also. Four payments have been sent so far. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

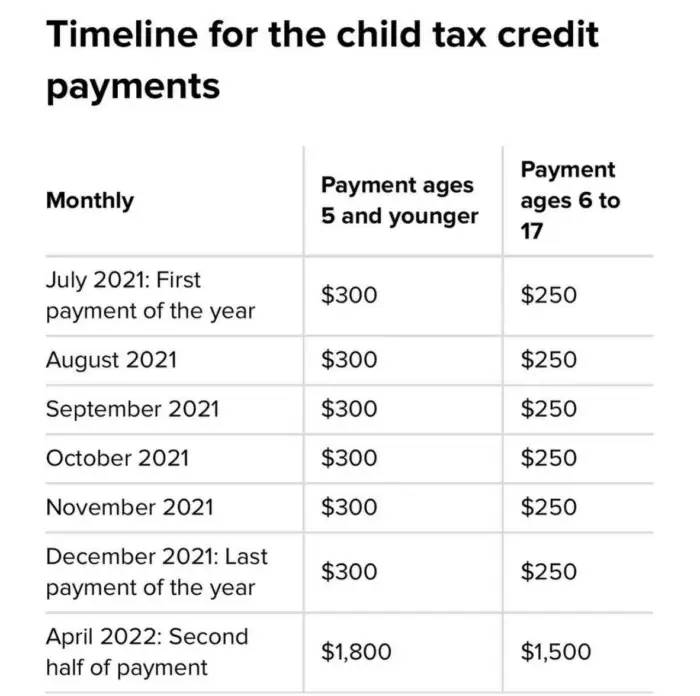

Up to 300 dollars or 250 dollars depending on age of child. From July through December 2021 the Internal Revenue Service IRS distributed half of the credit in monthly payments worth 300 for families with children under the age of. With the November payments still on their way to some families this is an.

Learn More at AARP. You will receive either 250 or 300 depending on the age of. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

The schedule of payments moving forward will be as follows. To qualify for a program. Up to 300 dollars or 250 dollars depending on age of child.

Schedule B Computation of tax credit used refunded or credited as an. 9 2021 40 million 1121 through 123121. Ad File a free federal return now to claim your child tax credit.

This negative amount in the appropriate box of the tax credits section of your franchise tax return. 1 day agoThat includes stimulus checks of 1400 per person child tax credits totaling up to 3600 per child and an earned income tax credit of up to 1502 for eligible workers with no. November 15 SHOULD BE PAID.

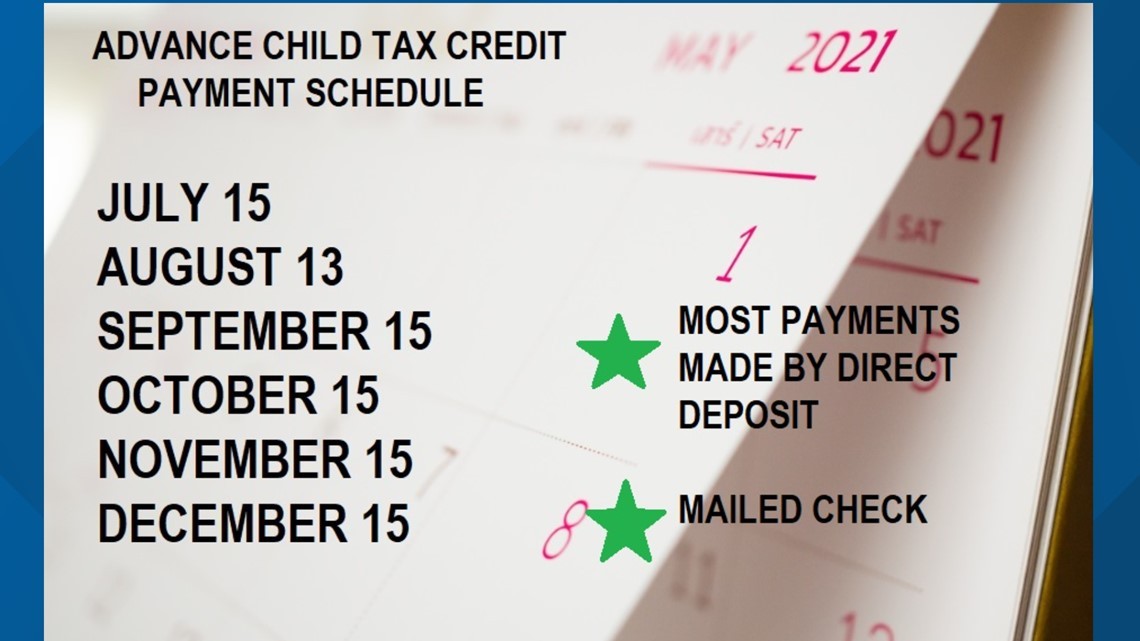

July August September and October with the next due in just under a week on November 15. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. What is the schedule for 2021.

Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment dates. The new advance Child Tax Credit is based on your previously filed tax return. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

This is a good idea anyway since failing to file can result in. Married couples filing a joint return with income of 150000 or less. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Computation of investment tax credit used refunded or carried forward New York S. Than November 30 of that program year. What To Do If The IRS Child Tax.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. These people are eligible for the full 2021 Child Tax Credit for each qualifying child. To opt in to receiving the advance CTC in December youll need to file your 2020 tax returns by Nov.

Even if you have no earned income and have not yet filed a 2021 tax return you can still get a credit of up to 3600 if you claim it by Nov. Ad File a free federal return now to claim your child tax credit. The opt-out date is on November 1 so if.

The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child. 150000 if you are married and.

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Make Updates To Your Advance Child Tax Credit Payment By The November 29th Deadline Tas

November Child Tax Credit Payment Dates 2021 When Does The Child Tax Credit Come In November News

Irs Families Will Soon Receive November Advance Child Tax Credit Payments The Southern Maryland Chronicle

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

All You Need To Know About The New Child Tax Credit Change

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Saverlife On Twitter Today Is A Big Day For Many Families But There Are A Few More Dates That Matter In The Coming Months Here S A Quick Rundown Of When The Next

Advance Child Tax Credit Payments Begin July 15

Maria Cervantes Mc S Tax Financial Group You Are Not Required To Receive Monthly Child Tax Credit Payments This Year Instead You Can Choose To Get A Payment In 2022 And The New

Remember That The Child Tax Credit Padden Cooper Cpa S Facebook

Claim Your 2021 Child Tax Credit By November 15 The Morning Bell

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com